Trends and technologies fueling growth

Desalination technologies enable the treatment of difficult wastewaters across an array of industries such as oil and gas and mining. They also alleviate water supply constraints where source water is scarce.

According to the recently published IDA Water Security Handbook, the industrial desalination market is growing, with contracted capacity rising 21 percent between 2016 and 2017. A third of that is attributed to upstream and downstream oil and gas, specifically.

“Desalination in industrial applications is experiencing important growth in oil and gas upstream applications worldwide, either with nanofiltration of seawater or brine injection to increase the oil extraction from reservoirs,” noted Miguel Angel Sanz, president of the International Desalination Association.

A view across a reverse osmosis desalination plant. Photo: James Grellier.

Spanish firm ACCIONA Agua, for example, is building the Al-Khobar 1 desalination plant on Saudi Arabia’s east coast. The $230 million plant will have a capacity of 210,000 m3 per day and, in addition to serving a population of 350,000, will supply water to Aramco, the world’s largest oil company.

WABAG, headquartered in India, recently inked a $70 million (INR 467 Crore) contract to supply engineering and construction for a 30-million-liter-per-day (MLD) seawater desalination plant for Mangalore Refinery and Petrochemicals Limited (MRPL) in Mangaluru, Karnataka. The plant, which will be expandable up to 70 MLD, will use seawater reverse osmosis (SWRO), brackish water reverse osmosis and ultrafiltration systems. Eleven kilometers of pipe will deliver water to MRPL’s refinery, minimizing the facility’s fresh water dependency.

But another industry leveraging desalination is hot on its heels. “We are also seeing growth of desalination in mining activities in Latin America, desalinating seawater and pumping to the mines,” said Sanz, adding that “Chile and Peru are leading the use of SWRO.”

The mining sector has enjoyed rising commodity prices, which in turn have breathed new life into desalination activity. The IDA handbook reveals 201,000 m3/d of new contracted capacity just in the first half of 2018.

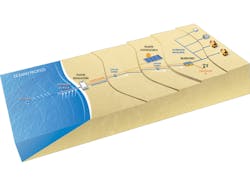

Schematic of TRENDS Industrial’s ENAPAC desalination facility to be built in the water-stressed Atacama Region of Chile.

In December 2018, a report from Chile’s state copper agency, Comision Chilena del Cobre (Cochilco), predicted the country’s use of seawater for thirsty industrial processes will triple over the next 10 years, increasing 230 percent over 2018 levels. This, as producers in arid, water-stressed regions of Chile seek alternative water supply sources to reduce their impact on water resources.

One high-profile project is TRENDS Industrial’s ENAPAC (Energías y Aguas del Pacífico) planned desalination facility in Chile’s water-stressed Atacama Region. In September 2018, the project got the green light from Chile’s local environmental authority after more than a year of review. The $500 million plant will have a maximum capacity of 2,630 liters per second (L/s), which will make it the largest desalination facility in Latin America when completed.

According to Cochilco, several new or expanded desalination facilities will contribute to those figures, including the recently opened Escondida Water Supply (EWS) desalination plant in the Antofagasta region — and current holder of the title of largest desalination plant in South America. The plant, operated by BHP, was inaugurated in April 2018 and has a capacity of 2,500 L/s. It complements an existing 525-L/s plant, which has been in operation for twelve years.

In a press release, Daniel Malchuk, president of BHP Minerals Americas, said, “In Chile, we aspire to cease using fresh water altogether as from 2030. We have progressed in this transition and will continue to do so gradually over the next ten years.” The Escondida plant, he said, “reflects our deeply held belief that it is possible to practice sustainable mining, which is both an ethical imperative and a fundamental condition for the business.”

Reverse osmosis is the leading desalination technology according to Sanz.

Advancing Desalination Technology

In terms of desalination technologies, reverse osmosis (RO) is the reigning king “due to the progress made in pretreatment, membrane permeability, energy efficiency and chemicals optimization,” said Sanz. In fact, the IDA handbook notes that membranes account for 90 percent of desalination capacity contracted since 2010.

Despite advances, the energy requirements — and associated cost — of desalination technologies persist. “Desalination is a particularly expensive method of sourcing water,” said Erin Bonney Casey, a research director with Boston-based Bluefield Research. “You have to have an industry that can support that kind of cost of water. You also have to have the climatic conditions that make desal really your only option.”

To that end, a number of exciting initiatives are underway to figure out how to make desalination more accessible and budget-friendly.

In December 2018, recognizing the intertwined relationship between water and energy, the U.S. Department of Energy (DOE) announced $100 million to establish an Energy-Water Desalination Hub. Its goal is to address water security issues in the United States by focusing on early-stage research and development (R&D) for energy-efficient and cost-competitive desalination technologies.

The Escondida mine, located in northern Chile, is the world’s largest copper producer. Photo: BHP.

“By focusing R&D efforts on advancing transformational technologies that promote cost-effective desalination, we are working towards meeting the national and global need for secure, affordable water,” said U.S. Secretary of Energy Rick Perry in a statement.

The Hub will be led by DOE’s Office of Energy Efficiency and Renewable Energy’s (EERE) Advanced Manufacturing Office. It represents an important component of the DOE’s larger Water Security Grand Challenge, which comprises a suite of competitions and prizes to catalyze energy-water nexus innovations.

Ultimately, the goal of the Hub is to focus on energy-efficient and low-cost desalination technologies that would treat non-traditional water sources in a way that would be cost-competitive with existing water sources (i.e., that would achieve “pipe parity”). According to DOE analysis, it takes approximately 3.2 kilowatt hours per cubic meter (kWh/m3) to purify seawater and brackish waters and costs an average of $1.50/m3. In contrast, producing drinking water from fresh water uses only 0.29 kWh/m3, and costs an average of $0.50/m3 to extract, convey, and treat.

DOE intends to select and fund one application to be announced in August 2019.

Based on measurements taken at more than 100,000 wells around the U.S., MIT researchers identified locations, indicated by green dots, that have a combination of a severe shortage of freshwater and a large reserve of brackish groundwater that could potentially be desalinated and used.

Targeted Treatment

Brackish groundwater desalination is another water supply strategy in water-scarce regions, but in the U.S. it’s largely untapped. While about a fifth of the nation’s water supply comes from fresh groundwater, less than 1 percent currently comes from brackish groundwater. In part, that’s because of the energy-intensiveness of desalination technologies, which have been primarily optimized for seawater, whose composition is fairly consistent around the world. Brackish water, by comparison, has a varied composition.

New research out of MIT, however, suggests that there’s a way to improve the energy requirements of desalinating brackish groundwater by tailoring the technology to a specific well’s composition.

MIT scientists identified five different classes of brackish groundwater composition. Each would require a different pretreatment approach with varying levels of energy required.

The researchers believe that information, coupled with a map of usable brackish groundwater sources, could help better inform decisions when developing new water sources.

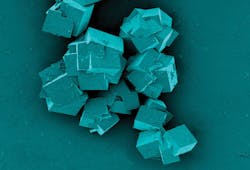

A scanning electron microscope image of metal-organic frameworks, crystals that can separate lithium from seawater. Photo: CSIRO.

Brine on the Brain

When it comes to desalination technology, the disposal of concentrated waste brine is an ongoing concern, and according to research from the United Nations University Institute for Water, Environment and Health (UNU-INWEH), the UN’s “think tank on water,” the problem could be worse than originally thought. Scientists studying newly updated statistics on desalination facilities estimate that the world’s 16,000 desalination plants discharge 142 million cubic meters of brine daily — 50 percent more than previously estimated.

Most of the brine (55 percent) is produced in four countries: Saudi Arabia (22 percent), UAE (20.2 percent), Kuwait (6.6 percent) and Qatar (5.8 percent). According to the researchers, brine disposal methods typically include direct discharge into oceans, surface water or sewers, deep well injection and brine evaporation ponds, depending on geography.

The scientists argue that the concentrated salinity, along with reduced oxygen levels and other chemicals present in brine waste, can contribute to ocean pollution and “have profound impacts on benthic organisms.”

But it’s not all doom and gloom. The researchers highlight economic opportunities to use brine, such as in aquaculture, to generate electricity, or to recover useful substances like magnesium, calcium, potassium, and lithium, a substance that’s used to power myriad electronic devices like our beloved cell phones.

According to IDA’s Sanz, solving these two major challenges — disposal of brine in sensitive areas and reducing the amount of energy used — is the “Holy Grail” the desalination industry is chasing. “In this way, technologies like reverse electrodialysis (RED), salinity gradient technologies with membranes, and liquid ion exchanges resins using waste heat sources offer some promising clues to a technological breakthrough.”

RED, in essence, seeks to produce energy from the ionic difference (or gradient) between salt water and fresh water passed between membranes. Energy builds up in the membranes, like a battery, and can be used to drive an electric current.

Inspired by Nature

A team of researchers from Monash University (Australia), the Chinese Academy of Sciences, University of Texas-Austin, and Australian research agency CSIRO believe they’ve found a way to desalinate seawater that’s more energy efficient, more sustainable, and more cost effective than current technologies. They’ve discovered that membranes made of a next-generation material called MOF (metal-organic frameworks) can mimic cells’ permeability, allowing only certain molecules through while repelling others.

MOFs function similarly to RO but, because they are designed to only let water pass through, they do not require pressure (and thus require much less energy). MOFs could also be utilized to treat industrial wastewater — targeting and extracting specific compounds, like precious lithium, cheaply and easily, from waste brine.