There’s been a lot of talk about the impact of tight utility budgets on municipal water spend, but what about industrial water opportunities? The impacts of COVID-19 continue to be acutely felt across the global industrial landscape with disparate government and company responses to remote workforces and onsite operations. While the opportunities vary by industry and timing, Bluefield’s water experts also see bright spots to turn to, including recent mergers and acquisitions from established industrial players.

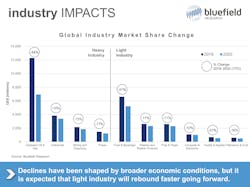

At a topline, according to Bluefield’s recently updated industrial water market forecasts for the Organization for Economic Co-operation and Development (OECD) countries, revenue will decline by almost 23% from 2019 to 2020. But the biggest difference from Bluefield’s detailed municipal outlook is that industrial markets are forecasted to rebound more quickly. Here are some key takeaways from recent analysis.

Market Volatility Drives Dynamic Approaches to More COVID-Resilient Industry Verticals

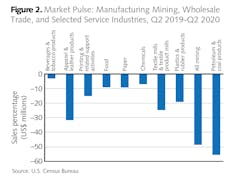

Each industry has its own pain points. Extractive industries (e.g., oil and gas and mining) are bearing the brunt of the downturn, partly because of reduced demand from China and OPEC. As a result, more nimble water solutions providers are shifting their attention to more buoyant sectors, including pharmaceutical, biotech, IT and electronics. They are also seeking channels for more digitally enabled solutions.

The drop in upstream oil and gas — which is a barometer of economic health — should have come as no surprise to anyone; it just happens that geopolitical disruption among producing countries coincided with the pandemic. The industry itself was already overleveraged and starting to soften. The price for a barrel of oil (bbl) in October 2020 now hovers around $38.99 and well below January 2020 prices of $57.52/bbl. The shock to mining may have yet fully played out. The scale and pace of change in mining is more often counter-cyclical, requiring large capital investments and global demand. China’s recovery alone will not do the trick.

Remote Work Prompts Changes Across Key Sectors

The sudden change to remote work is not only driving down demand for office apparel and the associated textile supply chain but accelerating the shift of consumer buying habits toward the internet. A driving force behind these multifaceted impacts is the “Amazon effect,” which will have even longer lasting effects on water management across several industries, including pulp and paper, data centers and electronics.

In prior years, Bluefield forecasted pronounced shifts in pulp and paper product consumption (i.e., declines in newsprint), volatile input costs, geographic shifts and changing environmental standards. While newsprint has declined more than 69% since 2005, a more stable paper and paperboard segment is expected to benefit in a post-COVID environment. Look no further than to front doors across the developed world, where household and now home office products in cardboard boxes await their retrieval.

More concerning is the shuttering of 16,000 restaurants in the United States because of the pandemic. While the food and beverage industry’s elasticity should enable a more rapid rebound, it hinges on federal, state and local leaders coalescing around a COVID-19 management strategy. The sector’s elasticity assumes more robust government response to the pains of the food and beverage industry, especially during the coming winter months.

On the back end of day-to-day trends is a robust technology sector — from hardware to the Internet of Things — on which the abovementioned Amazon effect is built. Increasing demand for products (e.g., computers, servers, switches) and in scaling reliance on thirsty data centers has not only been resilient but in growth mode. The impact of data-driven services (e.g., Zoom, Netflix) on water supplies and usage is not insignificant. Hyperscale data centers have significant cooling requirements and are therefore water intensive. Global data center water usage is projected to increase by 13% to 221 million gallons per day in 2021, which is up from 195 million gallons per day in 2015.

Global Impact Measured by COVID-19 Lockdowns

There is no one answer to sizing the impacts across the 18 industry verticals and almost 40 countries recently forecasted by Bluefield. Certainly, the virus and associated quarantines will continue to shape the recovery curve, but the makeup of local industrial economies is also critical, whether they be manufacturing centers, commodity markets, or those that are aimless in their COVID management.

Without doubt, China is the straw that stirs the industrial drink in many ways. Changes in its demand for raw materials (e.g., copper, oil, gas) sourced from other countries quickly ripples through the global economy. Key markets to look at are Brazil, Chile, Australia, and other commodity markets in Africa. At the same time, demand for Chinese-made products is increasingly ballasted by growing local needs; its manufacturing base still leans heavily on the U.S. and Europe for export.

It should be noted that the recent shock to the global supply chain — exacerbated by dependence on Chinese suppliers — has exposed unforeseen risks. Some companies had already begun to sour on China’s declining cost of production advantage, but COVID-19 has become an accelerant. The longer-term implications on company strategies will be supply chain diversification to reduce risks, including returning some activities to U.S. and European markets. For water players, this could spark additional greenfield water supply and management as companies reallocate geographic footprints.

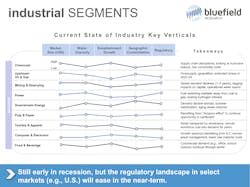

Economic Setback Regulatory Change

In times of financial stress, regulators are hard pressed to enact, if not enforce, tighter environmental controls on water and wastewater. If anything, the current administration in the U.S. has been relaxing, if not eliminating, environmental regulations. As a result, the near-term opportunity for advanced treatment will be modest but could receive a boost with a more environmentally focused Democratic Congress and White House.

Keeping things in perspective, large corporations, particularly those accustomed to significant capital outlays, look beyond the current horizon. Greater focus on advanced wastewater treatment is expected to scale over time, shaped not only by regulations but the bottom line. Water represents a key input to industrial production from hydraulic fracturing to hydrogen-based power. WT

About the Author: Cullen Mitchell is an analyst in Bluefield’s Boston office, where he is primarily focused on industrial water insights. Bluefield Research, a market research and insight firm, is focused exclusively on supporting vendors, utilities, and investors addressing opportunities in water. For more information about Bluefield’s industrial water research, go to www.bluefieldresearch.com/industrial-water.