Q&A: A walk down semiconductor lane with IDE Technologies

The semiconductor industry is the backbone of innovation today, producing chips and processors that power the digital world. With modern technology evolving at a never-seen-before pace, this industry is exploding — and quickly. In fact, recent data shows the global semiconductor market is projected to grow more than 200% by 2032, from $681.05 billion to $2062.59 billion.

While there is immense opportunity for this industry, there are also unique challenges that must be addressed, especially when it comes to water usage. Water Technology connected with IDE Technologies’ director of water treatment process, Roi Zaken Porat, to dig into the nuances of the semiconductor industry from a water-specific lens:

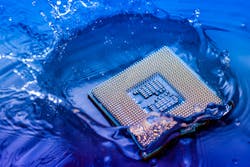

Q: Why is water quality so vital for the semiconductor industry?

A: Chips and processors are hyper-sensitive components, requiring ultra-clean water throughout the entirety of the production journey. Overlooking water quality can create a plethora of issues — from defects and compromised functionality to an immense decline in product reliability. In short, the semiconductor industry must have access to pure water for projects to run smoothly, just one of the many water challenges the industry faces today.

Q: What other water management challenges and risks is the industry facing?

A: While the semiconductor industry requires ultra-clean water, it does not return the water as it found it. In fact, the manufacturing process produces contaminated water and in the spirit of protecting the environment and overall public health, regulatory bodies have stringent standards around releasing this industrial wastewater discharge into the environment without proper treatment. Should the semiconductor industry turn their heads to these rules, they could be face-to-face with substantial fines and even legal consequences — but the challenges don’t stop here.

The semiconductor industry also has diminishing access to external water resources given regulators prioritize individual consumers over profitable businesses. Now, the pure water required comes at a hefty cost, cutting into organizations’ bottom lines. Those looking for a cost-effective, sustainable approach to semiconductor manufacturing are turning to water treatment technology.

Q: What water treatment technology does the industry leverage, if any?

A: The semiconductor industry's water treatment is generally divided into three main water treatment sections (besides the secondary users such as cooling towers and scrubbers). The three sections are the ultra-pure water (UPW), the special treatments and the end of pipe.

Each system has its own special attributes. For example, the UPW utilizes technologies such as ultra filtration (UF), reverse osmosis (RO), ultra violet (UV), electro de-ionization (EDI), ion exchangers (IX), degasser and others to ensure the highest purity water is produced to allow safe chips manufacturing.

The special treatments section is actually a collection of all the wastewater from the entire plant after the UPW was used with the addition of chemicals. There are various waste streams from various processes during manufacturing such as the CMP process water, the hydrofluoric acid treatment wastewater and others. It is worth mentioning that each semiconductor fab has its own unique attributes so processes will change from fab to fab and so will the wastewater.

The process to treat the water will vary according to the type of waste and can include technologies like clarifiers, activated carbon filters, IX, UV, etc. But a big portion of it is RO to allow significant water reclaim within the fab as the RO generates high quality products. For this section, the industry is constantly looking for technologies that will allow it to recycle more water given the challenging wastewater quality. IDE has worked to refine the conventional processes, introducing a disruptive industrial water treatment solution. This technology is called pulse-flow reverse osmosis (PFRO) and enables significantly higher water recovery rates compared to conventional reverse osmosis systems — without the complexity issues and with minimal downtime.

The third area is the end of pipe (EOP) which is actually the wastewater that is collected at the end of all of the upstream processes (the special treatments section) or directly from the process units to one neutralization basin. This water might still need treatment such as peroxide removal, ammonia treatment or organic matter removal. The common process is the membrane bio-reactor (MBR) to treat the water biologically followed by UF filtration.

In many cases today, because of regulation and public concern such as the rise of per- and polyfluoroalkyl substances (PFAS) regulations and because of the need for more water reclaim — extra water recovery systems can be applied, even up to zero liquid discharge systems (ZLD). To achieve this, RO and crystallizers are applied. The main task of the RO is to reach as high as possible water recovery so the expensive crystallizer at the tail will be as small as possible. Some plants take the direction of treating the MBR effluent with the high pH process, which involves many procedures, including lime softening and ion exchange for the removal of hardness, degasification for the removal of alkalinity and pH adjustment to keep the silica soluble. While effective, this process calls for substantial effort and is prone to malfunctions and is riddled with chemical use.

IDE has worked to refine the conventional processes, introducing another disruptive industrial water treatment solution. This technology is called MAX H2O Desalter and enables high water recovery rates at a neutral pH — without the complexity issues and the chemical demand associated with traditional methods. Of note, this process removes silica, which can notoriously scale the crystallizer heat transfer tube and make it difficult to achieve high recovery rates through treatment. This technology is reshaping industrial water treatment as we know it — and the innovation continues.

As outlined, there are many options for water treatment technology on the market today, allowing the semiconductor industry to get the pure water it needs to stay innovative and successful.

Q: How do you see the industry evolving in the next decade?

A: In the next decade, the semiconductor industry's water management evolution will be primarily driven by the imperative of water reclamation. As water scarcity intensifies, wastewater regulations become more stringent and chip manufacturers pursue ambitious sustainability goals, the focus will shift towards maximizing water reuse. This will necessitate significant advancements in water treatment technologies, particularly in higher water recovery RO systems.

Historically, fabs have mainly used reclaimed water for secondary purposes such as cooling tower makeup and scrubbers. However, the primary consumer of clean water is the UPW system, and fabs have been reluctant to reuse reclaimed wastewater for UPW production due to associated risks. It is clear that with increasing reclamation efforts, the reuse of reclaimed water for UPW production will become a significant factor in the years to come, and the industry will inevitably move in this direction.

About the Author

Roi Zaken Porat

Director of Water Treatment Process, IDE Technologies

Roi Zaken Porat is a process engineer, team leader and R&D manager at IDE Technologies. Roi has gained significant expertise in the field of RO and thermal desalination, nano-filtration and industrial wastewater management, and specializes in zero liquid discharge (ZLD) solutions.