The world is changing and so are the opportunities for water management across the industrial sector. In the wake of the COP21 climate meetings, a new Build Back Better infrastructure plan and global corporate ESG strategies, the proliferation of more advanced solutions is expected to accelerate. The result will be an increased focus on climate resiliency, digital hardware, software and analytics, and workforce management in a post-COVID-19 environment.

Here are a few trends that our water experts have been tracking closely.

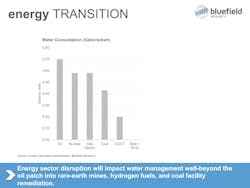

Energy transition opens door to long-term water management opportunities

The rapid changes across the power landscape are forecasted to reshape water demand going forward. Traditional focus on water for power has changed dramatically, and renewables will take on a bigger share of additions. Forecasted additions of solar and wind facilities over the next seven years, coupled with ongoing retirements of water-intensive fossil fuel and nuclear plants, will cut the power sector’s water footprint by 8% from 2020 to 2030.

The longer-term implications for the energy sector include new water demands for the energy supply chain. A growing focus on rare earth metals for electric vehicle batteries and water supplies for hydrogen-powered transportation and electric storage will usher in new opportunities for water supplies and management. As a result, the mining, power and automotive sectors are set to become the new water-intensive sectors to watch.

A move to plant-based foods changes water opportunities

Changing consumer habits catalyzed by concerns about environmental impact, climate-related risks and animal welfare, coupled with the proliferation of corporate sustainability initiatives, will drive new opportunities for water solutions providers. In 2020, plant-based food product sales grew by 27% compared to 2019, which propelled the market segment past $7 billion in annual sales, according to the Good Food Institute. While this rapid growth in alternatives to meat, eggs and dairy products gains momentum, the growth also points to improved water efficiencies in the food supply chain — new production facilities and reduced water usage.

While plant-based food companies such as Impossible Foods, Beyond Meat and Alpro have not set water-specific management targets, their products are inherently more water efficient than meat-based products. Initiatives have varied from water usage tracking to deploying reuse systems (e.g., Alpro, Impossible Foods). At the same time, multinational parent companies of plant-based product brands can utilize plant-based alternatives to further sustainability goals, which are increasingly focusing on water usage.

Thirsty agricultural sector looks to innovation to reduce water footprint and increase resilience

The convergence of external forces, such as more devastating climate-related events, innovative new technology solutions and alternative business models has thrust more efficient water management to the top of the priority list in a $5 trillion agriculture sector, globally. Of the commonly deployed irrigation methods, more efficient drip systems have grown 19% in the U.S. since 2013. This transition away from more traditional gravity and sprinkler systems toward lower flow, drip irrigation is expected to accelerate, not only in more mercurial, drought-stricken water markets like the western U.S. and Australia but also in regions where groundwater aquifers are under threat to excessive withdrawals.

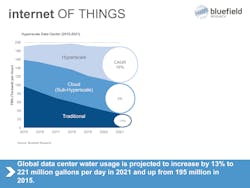

Big Tech’s reliance on data centers puts focus on water needs

From Zoom to Netflix to Bitcoin, data center usage is higher than ever before. The rise of remote work and digitalization of operations are accelerating the transition to water-intensive, hyperscale data centers. In the context of water, the number and size of these larger centers will demand greater volumes of water (and need for efficiency gains) for cooling systems.

Over the past five years, the number of hyperscale data centers has almost doubled with approximately 38% of these located within the United States. This growth has been driven by a core group of 25 companies that make up the majority ownership of the hyperscale centers around the world. As the number of centers continues to grow, the projected water usage is expected to reach 221 million gallons per day by 2021. Cooling, traditionally the largest share of data center costs, will require companies to examine different opportunities for spend optimization.

Looking ahead, proposed infrastructure stimulus measures and corporate sustainability investments across industrial sectors are expected to drive continued water market growth in the medium to long term. But extreme climate events, supply chain pressures, staffing and hiring challenges, and economic and geopolitical uncertainty will continue to impact water market strategies. To adapt to these market shifts, industries will continue to re-evaluate their water market strategies.

“Water positivity” takes hold within corporate water sustainability

Since Microsoft announced its goal to become water positive by 2030, companies across various industries including PepsiCo, Facebook and IKEA have followed suit. While a host of multinational firms appear to be coming to terms with this new normal through water-specific strategies including green bonds, partnerships with NGOs and in-house water technology solutions, successful execution across myriad facilities and geographies still represents a significant hurdle.

At the forefront of these recent announcements are mostly consumer-facing companies, seeking to insulate their brands amid public calls for more sustainable approaches to water and carbon. The opportunity for water companies will stem from the anticipated growth in adoption of on-site reuse, rainwater catchment and improvements in operating efficiencies.

A digital and industrial water convergence

With corporations and industrial players increasingly including water management in their sustainability targets and strategies, this is creating new market opportunities for digital water and wastewater treatment plant optimization solutions. Greater plant optimization enables industrial plant operators to better monitor, manage and ultimately reduce consumption of key inputs such as power, water and chemicals with real-time data.

As water and wastewater plant managers place more emphasis on resource efficiency, a growing roster of solutions providers are entering the digital plant optimization space. These include both established water industry players (e.g., equipment suppliers, engineering firms) and pure-play startups, some of which are seeking to translate tools developed for the municipal utility sector to faster growing, less bureaucratic industrial verticals.

Reese Tisdale has an extensive background in industry research, strategic advisory and environmental consulting in the water, power and energy sectors. Prior to co-founding Bluefield Research, Tisdale was research director for IHS Emerging Energy Research, a research and advisory firm focused on renewable energy markets and competitive strategies. He also has demonstrated experience in groundwater remediation for oil and gas companies and as an international market analyst for what is now Thermo Fisher Scientific. Tisdale has been cited by Bloomberg News, CBS News, The Wall Street Journal, The New York Times and a range of industry publications. He received a Bachelor of Science in natural resources from The University of the South, Sewanee, and a Master in Business Administration from Thunderbird: The American Graduate School of International Management.