By Jeff Gunderson

Oil and gas production is a colossal, fast-evolving, and wide-ranging industry that is shaped by significant market drivers, is vital to the global economy, and represents the world's largest industry in terms of capital value. Like the industry itself, water and wastewater treatment in oil and gas is broad and complex, with numerous issues, and spanning several areas -- from the upstream and downstream segments to conventional oil and gas to the unconventional plays including shale gas and liquids, coalbed methane, tight gas, and heavy oil, among others.

Oil and gas is not just one market, it's many markets, and some have water and wastewater treatment challenges that are highly specific and require unique and increasingly innovative solutions, observed Jonathan Rhone, president and CEO of Vancouver, B.C.-based Axine Water Technologies.

Many of the treatment issues in oil and gas are also based on the regional geology, much like the mining industry, said Rosemary Niechcial, director of infrastructure – mining, oil & gas with Black & Veatch. "For example, there are treatment challenges specific to the Alberta oil sands or the Bakken Shale Formation that aren't found anywhere else in the world," she said.

In recent years, the industry as a whole has begun to experience a significant change as increasingly more attention moves towards unconventional sources. In An Overview of Unconventional Oil and Natural Gas: Resources and Federal Actions, a report prepared by the Congressional Research Service, advances in hydraulic fracturing, directional well drilling, and reservoir stimulation has enabled oil and gas production from tight, impermeable unconventional formations that were previously uneconomical to produce, changing the U.S. energy posture and global energy markets.

This global shift to unconventional sources represents a huge driver for the treatment industry and an enormous opportunity for new technologies, according to Rhone. "Many of the extraction techniques associated with these newer plays -- such as steam-assisted gravity drainage and water flood -- are very water- intensive and generate high volumes of wastewater, which can be very complicated," he said. "Plus, as many of the old oil fields reach the end of their productive lives, these methods are now also being used on conventional sources to drive out the last remaining hydrocarbons."

Water Recycling

As in other industries, water recycling is taking on increasing significance in the oil and gas industry, especially as water resources become scarcer.

"Raw water costs are also rising significantly, generating higher interest in adopting advanced technologies so that wastewater can be treated and recycled back in operations, reducing freshwater intake requirements," Rhone said.

Manish Backliwal, international business development manager with Aquatech, said due to stringent environmental regulations, oil companies are looking at economical and innovative ways to recycle more produced water as opposed to discharging it.

Backliwal, who specializes in upstream oil and gas, said companies are striving to recycle as much as 95 to 98 percent of produced water coming from enhanced oil recovery operations. "More and more, innovation in water recycling is being focused on addressing that last 2 to 5 percent and how to economically treat those highly-concentrated impurities," Backliwal said.

Water Sources

In addition to driving more water recycling, water scarcity is also pushing more oil and gas producers to find alternative, lower-quality sources of water that can be utilized for meeting process water needs. Doing so, however, can present a new set of treatment challenges.

"Brackish water is increasingly coming into the picture, but this type of water also has greater levels of total dissolved solids," Backliwal said. "The chemistry of the produced water can be very complex, with high concentrations of organics, silica or other elements creating distinct treatment challenges."

As higher quality sources become more difficult to access, oil and gas companies are also turning more to wastewater treatment plant effluent, according to Black & Veatch's Niechcial. "We are seeing more of this across the board, wherever an operation is in close proximity to a municipality, such as in Mexico," she said.

"But in many cases, the newer unconventional plays are not located within easy distance to municipalities," she added. "Then, the trend is to utilize poorer-quality, non-potable water, and this is where the treatment challenges really come in because a lot of these sources are highly saline."

Technologies, Innovations and Solutions

Many long-standing and new drivers in the oil and gas industry, propelled by macro demands, are continuously pushing the market in terms of the development of new treatment technologies and innovations. In addition to solutions that help solve problems such as meeting higher water quality discharge requirements, end users increasingly need solutions that are more adaptive, robust and that are capable of treating more problematic sourced water. At the same time, oil and gas companies are also pressing for technologies that offer greater treatment performance at lower costs.

Becky Tomasek, upstream market sector leader for CH2M HILL's water market, said as the upstream industry moves towards more brackish water use, companies are relying more and more on chemical addition and mechanical filtration for removing iron and other metals that can cause scaling. "For hydraulic fracturing, many operators want to develop a clean brine from either brackish water sources or recycled produced water, and so in some cases they are focusing on removing suspended solids and hardness," Tomasek said. "If the produced water isn't needed, then flash evaporation can be used, leaving only the solids to be discharged."

In terms of treatment innovations, Tomasek sees advancements both in membranes and in distillation. "A lot of the new water sources have total dissolved solids levels that are higher than what a typical membrane can handle. So we are seeing more robust, ceramic-type membranes that can withstand the fouling that may occur," she said. "With distillation, technologies are being introduced that can vaporize and condense salt water in a very efficient fashion"

Devesh Mittal, vice president and general manager of Aquatech's shale gas division, said fluctuating oil and gas prices are prompting drillers to move operations more frequently, which in turn is forcing treatment specialists to be more adaptive. "Oil and gas is a constantly-changing industry. Drillers will change plans quickly and move to another formation if the economics of drilling are more favorable," he said.

For example, more drillers right now are shifting to the oil- or liquid-bearing regions because oil prices are collectively higher than the price of gas, Mittal noted. "When these shifts occur, we need to be able to respond quickly, have the right assets in the correct locations, and be prepared to handle new water characteristics and different water balance dynamics," he said.

For meeting challenges associated with changing treatment needs, Aquatech provides solutions that are flexible, adaptive and that offer service in multiple formats, according to Mittal. "We are also focusing on making systems simpler and developing combined solutions that are capable of serving the broader oil and gas market," he said.

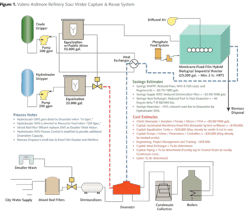

Indeed, in many instances, solutions to problems may not necessarily require new technologies but rather an integration of existing technologies, said Samir Davé, downstream market sector leader for CH2M HILL's water market. "What matters are the technologies chosen, how they are integrated and in what sequence they are used," Davé said. "The treatment strategies should also vary based on the dynamics of the formation. For example, the water characteristics in the Eagle Ford Formation could be very different compared to the Marcellus Shale, requiring different approaches."

An integrated approach is also critical in addressing challenges on the downstream side of the industry, Davé said. "We are seeing lots of interest from clients who need help meeting very stringent limits related to nitrogen, phosphorus, metals like copper and selenium, and also with regard to effluent temperature," he said. "With regulations requiring selenium to be removed to parts per billion level, an integration of technologies is needed."

Another area of focused innovation and development is in the design of modular treatment systems that are compact, easily-transported and can be installed very quickly.

"These types of units are inspired by the off-shore industry where space is at a premium and can be very effective in places where labor costs are high, such as Alberta and Australia," said Aquatech's Backliwal. "Since modular treatment systems are already essentially built, the onsite installations are mainly limited to assembly, which can be much more cost-effective."

Aquatech has developed a modular evaporator specifically for the oil sands market that is flexible, redeployable and engineered to withstand the extreme climate of northern Alberta. Called the SmartMOD, the technology is capable of significantly reducing field installation labor and costs.

About the Author: Jeff Gunderson is a correspondent for Industrial WaterWorld. He is a professional writer with over 10 years of experience, specializing in areas connected to water, environment and building, including wastewater, stormwater, infrastructure, natural resources, and sustainable design. He holds a master's degree in environmental science and engineering from the Colorado School of Mines and a bachelor's degree in general science from the University of Oregon.